Loan Origination System (LOS)

With the Loan Origination System (LOS), you can easily, quickly, and safely organize and process your customer data to make retail loans.

Are you looking for a loan?

If so, you know that the process can be long and complicated. You must fill out paperwork, provide documentation, and wait for approval. But what if there was a way to make the process easier?

That’s where a loan origination system comes in. A loan origination system is a software application that automates the loan process. This means that you can apply for a loan online, and the system will take care of the rest. You’ll get approved faster, and you’ll have access to more money.

![]() Easy to Use

Easy to Use

![]() No Complex Installation

No Complex Installation

![]() Website Based

Website Based

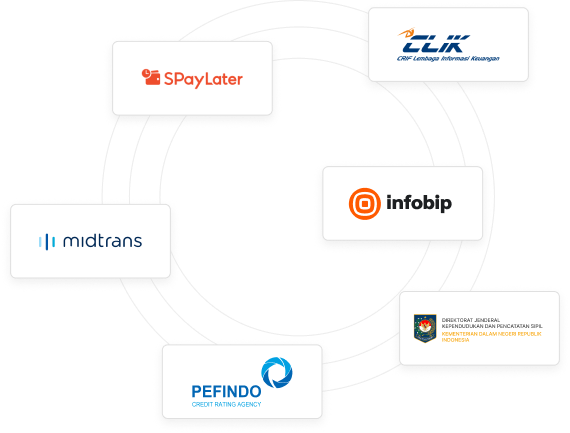

LOS External Service

LOS currently have 6 external service to support the process of customer data screening:

- PEFINDO – customer credit score

- DUKCAPIL – identity

- CLIK – customer credit score

- SPayLetter ST Score – phone number score

- MIDTRANS – checking account number

- INFOBIP – SMS & WhatsApp gateway

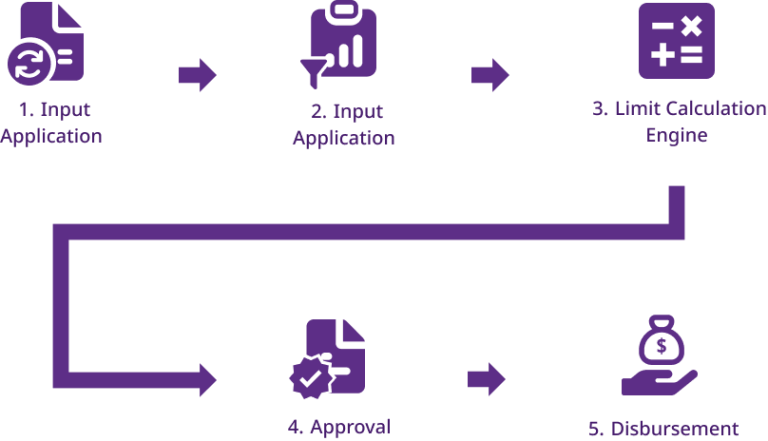

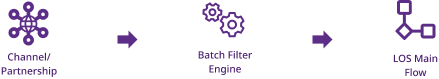

LOS Process

The Loan Origination System (LOS) process is the process of getting a loan from a lender. It can be a long and complicated process, but it can be made easier with the help of a loan origination system.

Here is a step-by-step guide to the loan origination process:

Input Application

There is a two way to processing the loan that we can handle.

Online Process

Offline Process

LOS Benefits

There is a two way to processing the loan that we can handle. Loan origination system (LOS) is a software application that automates the loan process. This means that you can apply for a loan online, and the system will take care of the rest. You’ll get approved faster, and you’ll have access to more money.

![]() Easy Application

Easy Application

You can apply for a loan online, in just a few minutes.

![]() Fast Online Proccessing

Fast Online Proccessing

Loan process is very quickly and only a one-day process is approved by the system.

![]() Increased efficiency

Increased efficiency

Loan origination system can help you streamline your loan process, which can save you time and money.

![]() Improved accuracy

Improved accuracy

Loan origination system can help you reduce errors in your loan process, which can protect you from costly mistakes.

![]() Enhanced compliance

Enhanced compliance

Loan origination system can help you ensure that your loan process complies with all applicable regulations.

Have a question or need IT support?

PT Next Transformtech Indonesia

Member of Hana Financial Group (HFG)

Head Quarter

![]() Mangkuluhur City Office Tower One – 16ᵗʰ floor

Mangkuluhur City Office Tower One – 16ᵗʰ floor

Jl. Jend. Gatot Subroto Kav 1-3 Jakarta 12930

Follow Us